UPSers/UPS is one of the largest trucking companies in the United States. UPS (United Parcel Services) also provides management and logistics services nationwide with a world-class supply chain service. UPS’s primary focus is package delivery, parcels, and all other basic parcel services, such as document delivery.

UPS has established itself in various regions of the world, including countries in Europe, Asia-Pacific, Canada, and Latin America, the Indian subcontinent, the Middle East, and Africa. The company always strives to provide the highest quality international shipping and delivery services within a limited period of time.

Portal Sign Up Process For New Users

To register on this online portal, you need to follow a few very simple steps. Registering on this online portal requires a little extra time and effort on your part. In this online portal, we explain each step of the registration. Check out the same below:

- Open your favorite browser and visit the official website UPSers.com. You can use any web browser to access the online portal, but we recommend Google Chrome for this.

- When you get to the official website, click the “Register” button.

- Submit the required information such as email id and password.

- Answer security questions. Please note the responses you send during this process as they will be necessary if you forget your UPS credentials.

- Enter the address and complete the registration process.

- The previous step completes the registration process for your UPSers account. You can now log in and access your UPSers account.

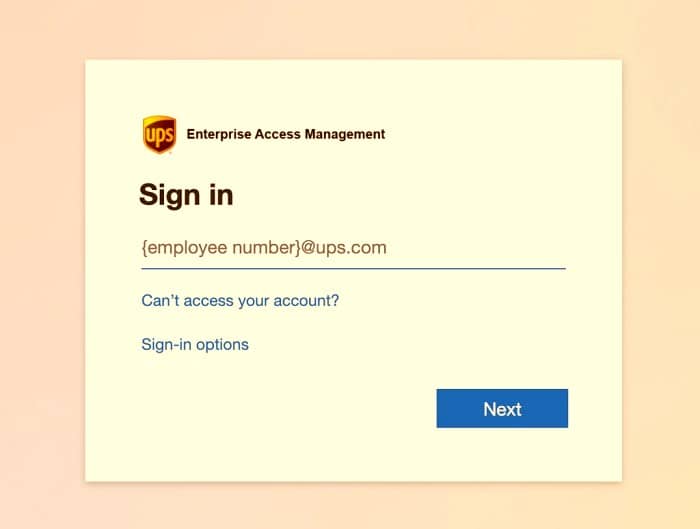

Follow The Steps For Portal Login Process

What happens after successful registration? If you now want to access your company data, you must log in to the official portal. The registration and use of the portal services are extremely easy for users. Discover the registration process for this portal below:

- To begin the registration process, visit the official portal at UPSers.com.

- Go ahead now and you will see the option “Sign in”.

- Click on this option.

- You will now be redirected to the login page of this portal.

- Here you will see two text fields asking you to enter your username and password.

- These are the credentials you provided during the registration process.

- We hope you remember. Enter this information in the required fields.

- Please check the submitted information once after entering it.

- Now click on the “Register” button.

- If the information you entered is correct, you will be redirected to your account home page.

- From there you can access details such as work hours, benefits, payroll, etc.

United Parcel (UPSers) began life in 1907 as a courier company in Seattle, Washington. Today it is one of the largest package and shipping companies. United Parcel Service is based in the United States.

UPSers from all over the world work for this organization in various departments such as UPS Store, Supply Chain Solutions, Airlines, Freight, Logistics, etc. However, the primary services of UPSers.com are shipping and logistics. UPS users deliver approximately 15 million packages every day.

What is UPSers?

UPS is one of the largest private parcel services in the world. They have thousands of employees who work day after day to deliver our packages. The global logistics company uses the UPSers platform as a workforce management tool. As the largest shipping and packaging company in the United States, they have a reputation that must be upheld.

This tool allows you to properly manage human resources throughout the company. The UPSers website is intended for UPS employees and corporate vendors only. Each company employee is assigned a unique username and password to log in and access the UPS control panel. All active members, as well as inactive members with valid ID, can join the platform.

How Do I Login To The Account Via Mobile?

This is a fair question. You can easily log into your account online from your mobile phone simply by following the steps below:

- You must visit the official portal UPSers.com from your preferred browser.

- Select the language in which you want to access the UPSers portal.

- Enter your “connection details”.

- After entering the “Login Details”, press the “Login” button and you will be taken to your account home page.

Please note that UPSers has not yet created an employee app. You must use your smartphone’s web browser to access the UPSers account on your cell phone. However, you can access the same information from your mobile phone and your computer. Do not worry.

Why Consider Login Portal?

If you belong to the current UPSers employee organization, there are several reasons to consider the UPSers employee login portal. In an era where networks were disconnected, there was a major problem with managing the employee database and issues like payroll, extended entry time, and business-relevant aspects.

And those things were done manually, like scheduling appointments, meeting with managers, and solving problems through lengthy and time-consuming discussions. And there may be biased opinions and solutions that are interpersonal and may not be transparent to executives who are laid off after the launch of the UPSers login portal.

UPSers Login is a portal that has made life much easier for senior employees. Simply visit the official website at www.UPSers.com to access the online portal. All UPS employees can access their accounts online at the official website UPSers.com.

When you log into your portal account, you can access services like payroll, 401K plan, package tracking, work time review, health care review, and more. Connect UPS is one of UPS’s most incredible and successful efforts to improve the lives of its employees. Easier.

Take A Look At Some Account Benefits

The UPSers portal offers a wide range of options to bring friends, family, education, and work together under one roof and covers almost any need. This online portal aims to meet the expectations and needs of customers through high-quality service.

- UPS air and international services save 18%. Plus, save 9% with UPS Ground Service.

- The 401k plan saves a lot of money, ensuring a better future for the UPS employee.

- The account on this portal offers attractive discounts and lucrative offers.

- Many startups benefit from UPS advice and support. UPS STORE has the tools you need to grow your small business. UPS has expanded its services to more than 220 countries.

- Today, UPSers is the world’s leading provider of parcel services. UPS also offers a variety of employee benefit plans to meet the health and wellness needs of large numbers of employees.

- UPS users can log into the portal with their ID (which is no longer than the employee ID) and password. Please note that new employees or new users must create a portal account. By registering the account, the employee receives the login information that allows him to access this portal on the official website.

| Official Name | UPSers |

|---|---|

| Usage | Employee Login |

| Launched By | UPS |

| Necessities | Employee ID, Password |

| Country | USA |

Forgot Password? Recover With Given Steps

The person forgets and you are also a person! As a result, you may forget your UPSers.com password. Some basic steps are required to recover the UPSers password. Take a look at the following steps:

- Visit the official site of this online portal.

- Press the “I forgot my password” button.

- You will be redirected to the new page.

- Please enter your valid user ID.

- Press “Submit”.

- A series of security questions that you answered during registration will appear on the screen. Answer these questions.

- If these answers are correct, you can change your password.

- Please note that the security questions you answered must be correct and match the ones you answered when registering. If you don’t answer these questions, don’t change your password and your account will likely be locked out.

You have two options for answering the questions. Then your account will be blocked. You will need to contact the technical staff to obtain your password and revalidate your account.

Below Are The Steps For Pin Generation

To generate the PIN-code on the official UPSers login portal, follow the steps explained:

- Visit UPSers.com

- Scroll down to find the new user ID and password.

- Fill in all the necessary information. Details include:

- The name of the company.

- Type of order.

- Deposit date.

- Surname.

- Employee identification.

UPS did not require all employees to sign up for this service. However, several leading partners and experienced employers recommend hiring employees. If you are a UPS representative, you have every reason to subscribe to the service.

At that time, the technology was not easily accessible, all data had to be tracked manually. With the advancement of technology, it is very easy for the company and its employees to keep up with the latest news.

What Are The Features Of the Portal?

UPSers Connection Portal offers users a wide range of functions. Many employees use it regularly for office and related activities. Each UPS employee must register on the official portal to receive services. This is what the portal offers to company employees. It is an attractive platform for countless people.

Simple Communication: communication is the key to success, it is the mantra of management. The UPSers portal makes it possible to close this communication gap between the authorities. Company staff believes the site is excellent when it comes to task management and routine operational updates. Managers can easily chat with their colleagues and members. Equipment management is simplified thanks to the online site.

Easy To Monitor: It’s tedious to do manual updates every day. The online portal makes it easy for users to evaluate their performance. The online portal allows users to regularly update their progress. This can be important in evaluating the employee and getting the job done. When you need to be in control, it is more relaxed and exciting. The excitement of your job has been found to affect your performance.

Employee Self-Service: The Self-Service Portal is an aid to employees. In this part of the website, users can control their data. It contains essential data such as salary information, monthly salary updates, leave management, daily service, and communication. It is a staple on all internal company websites. You can easily track your annual, monthly, or quarterly taxes and payments.

Frequently Asked Questions

What is the UPSers portal?

It is an online portal through which each employee can access their professional data.

Is this online portal safe for all employees to use?

Yes, UPSers are a very encrypted portal. Therefore, it can be said that this portal is extremely safe for all UPS employees.

Where can I access the official UPSers portal?

You can easily access this portal online at the website address www.upsers.com.

How can I use this online portal?

You can use this online portal to find information about your work, such as work hours, pay stubs, etc.

UPSers is an easy-to-use portal that makes it easy for employees. The main objective of the UPSers portal is to make everything accessible to the employee without any additional effort. UPS users recognize the importance of employees and therefore offer their employees the best possible services and incentives to do the same as their employees do for them.

About Portal

UPSers has created an online portal to make life easier for its employees. Your employees can log into the portal through the UPSers portal and access services such as payroll, reimbursements, etc. Each registered user receives a unique identifier. The password-protected individual account and the high level of encryption make this account significantly more secure.

UPS is often referred to as “brown” after the truck, and the uniform for this company is brown. Before you can use the benefits of the online portal, you must register on the portal.

The estimated net profit to users was around $ 3.4 billion, with an operating profit of around $ 5.9 billion. Net profit for top users is estimated at $ 60.9 billion. It is by far the largest company when it comes to parcel services.

For UPSer, the safety and satisfaction of its customers are a top priority. Their dedication and excellent services around the world have won a large number of clients around the world.

Conclusion

We publish this article so that users can easily understand the use of this portal. This can sometimes be difficult for first-time users of this portal. We hope this article removes some of the complications.

If you find this article helpful, please share it with your friends. We are happy to help everyone. Peace!